How do lenders determine how much to lend

Your DTI is basically a comparison between what you earn. Ad Get a Business Loan From The Top 7 Online Lenders.

What Do Banks Look For When Lending The 5 Cs Of Credit Ride Time

You obtain the Upfront Mortgage.

. Similarly if the credit history evidences a consistent pattern of. Here Are Some Of The Common Ways That Lenders Determine How Much You Can Borrow. Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

To calculate how much you can expect to pay for your total loan get the Upfront Mortgage Insurance rate and add it to the base loan amount. The first is a ratio of estimated monthly housing expenses principal interest property taxes and. If a loan applicant has a credit history that indicates creditors losing their investment on them then the perceived risk goes up.

A 20 down payment makes a lender feel much more secure than a 10 down payment. Trusted VA Home Loan Lender of 200000 Military Homebuyers. Find loans for country homes land construction home improvements and more.

Ad Well Match You Up To 5 Lenders For Your Best Credit Card Consolidation Loans. Traditionally mortgage lenders applied a multiple of your income to decide how much you could borrow. Lenders generally look for the ideal front-end ratio to be no more than 28 percent and the back-end ratio including all monthly debts to be no higher than 36 percent.

Traditionally mortgage lenders applied a multiple of your income to decide how much you could borrow. It helps them determine your ability to repay the funds within a specified time period. So if you earn 30000 per year and the lender will lend four times.

You will need to work backward by altering the. If you think youve. Student loans 250 credit card 100 car 300 mortgage 1000 1650 per month.

Ad Compare Loan Options Calculate Payments Get Quotes - All Online. Lenders ask for a variety of information when you apply for a loan. Percentage Of Gross Monthly Income Many lenders follow the rule that your monthly.

Heres an example of how your debt ratio could be calculated. To see if youll qualify for a. Generally speaking most prospective homeowners can afford to finance a property whose mortgage is between two and two-and-a-half times their annual.

When evaluating loan applications how lenders determine the creditworthiness of a borrower is assessed by reviewing the applicants history of credit and debt management. Lets then say your income is. Ad Apply online for a home or land mortgage loan through Rural 1st.

Mortgage lending discrimination is illegal. You can plug these numbers plus. How Much Mortgage Can I Afford.

The ratio is calculated by taking. To calculate your maximum monthly debt based on this ratio multiply your gross income by 043 and divide by 12. Generally most lenders want your debt-to-income ratio including your anticipated new monthly mortgage payment not to exceed 36 percent.

Credit Score Credit score is another key factor in determining your interest rate. To calculate your maximum monthly debt based on this ratio multiply your gross income by 043. Most lenders recommend that your DTI not exceed 43 of your gross income.

Compare Personal Loans And Lower Your Interest Rate By Consolidating Your Credit Cards. Mortgage lenders will typically use two ratios as part of the loan approval process. So if you earn 30000 per year and the lender will lend four times this.

Grow Your Business Now. Mortgage lenders typically decide how much to lend based on the borrowers income as well as the debt-to-income ratio DTI.

Peer To Peer Lending An Alternative Source Of Finance Peer To Peer Lending Money Management Advice Economics Lessons

/how-to-get-a-loan-315510_V1-e8212e1a3dfe43358308f689cf51a284.png)

How To Get A Loan From A Bank

Mortgage Ready Checklist Buying A Home Texaslending Com Home Buying Buying First Home Home Buying Process

/how-to-get-a-loan-315510_V1-e8212e1a3dfe43358308f689cf51a284.png)

How To Get A Loan From A Bank

How Much House Can I Afford Buying First Home Home Mortgage Mortgage Marketing

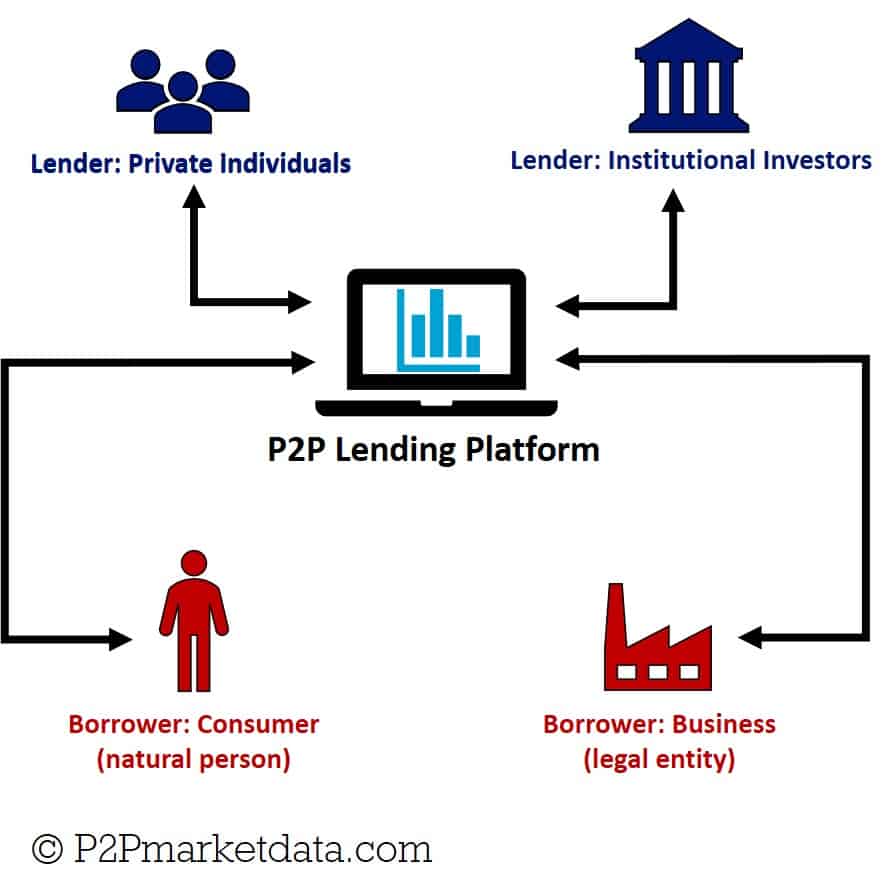

What Is Balance Sheet Lending And How Is It Different To P2p Lending

Is Underwriting The Last Step In The Mortgage Process Hbi Blog

Homebuyer Tips When Applying For A Mortgage Mortgage Loans Mortgage Process Refinance Mortgage

Applying For Loans Through Direct Lenders How To Apply Lenders Loan

Family Loan Agreements Lending Money To Family Friends

Understand The 5 C S Of Credit Before Applying For A Loan Forbes Advisor

Defi Lending And Borrowing Guide Yield App

Fha Vs Conventional Infograhic Mortgage Loans Home Loans Fha Mortgage

Need A Personal Loan Here S How To Find Loans And Apply

/Mortgage_Rates-final-72f37273e7994683ac3366ebc810881f.png)

Shopping For Mortgage Rates

Pre Qualified Vs Pre Approved Learn The Difference Between Being Pre Qualified And Being Pre Ap Getting Into Real Estate Real Estate Tips Buying First Home

5 Smart Things To Do With Your Refi Savings Smart Things Things To Do Done With You